|

how much cat insurance cost: clear numbers, context, and trade-offsWhat actually drives the priceInsurers price risk. Age, location, coverage depth, and the levers you choose (deductible, reimbursement, annual limit) move the number up or down. - Age: Kittens and young adults cost less; senior cats climb quickly.

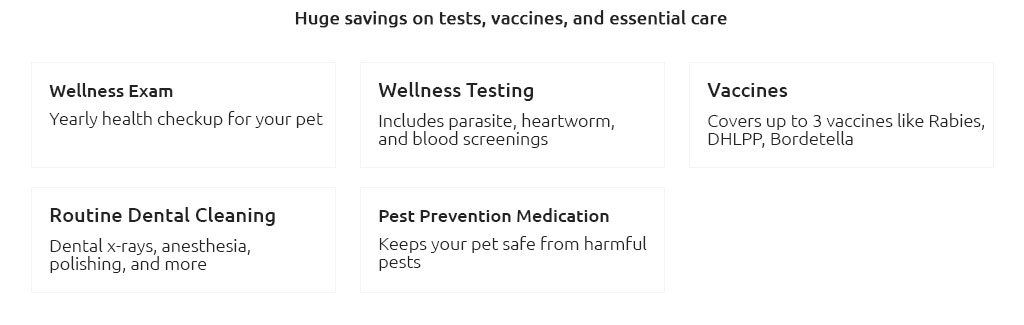

- Coverage type: Accident-only is cheapest, Accident + Illness is the standard, wellness add-ons are extra.

- Deductible & reimbursement: Higher deductibles and lower reimbursement percentages reduce the monthly bill.

- Annual limit: Lower limits lower premiums; unlimited raises them.

- ZIP code: Urban and coastal areas often run pricier due to higher vet costs.

- Breed & health history: Some carriers price for hereditary risks; mixed-breed tends to be moderate.

Typical monthly ranges (illustrative, not offers)- Accident-only: $10 - $20 for young cats; $15 - $30 for older cats.

- Accident + Illness (common choice): kittens - 2 yrs: $20 - $35; 3 - 6 yrs: $25 - $45; 7 - 10 yrs: $40 - $75; 11+ yrs: $60 - $110+.

- Wellness add-on: often an extra $10 - $25.

- Location swing: dense metros can run ~15 - 40% higher than low-cost regions.

Dialing the levers: quick impact check- Deductible: Moving from $250 to $500 often trims $5 - $12 per month for the same cat and coverage.

- Reimbursement: 90% to 70% can shave another $5 - $15 monthly, but you pay more at claim time.

- Annual limit: $5,000 vs. unlimited might differ by $6 - $18 monthly depending on age and market.

Snapshot example (one cat, one city)Indoor, 3-year-old mixed breed in a mid-cost city, Accident + Illness: at $250 deductible / 80% / $10k limit you might see $28 - $42 per month; nudge to $500 / 70% / $5k and that can land around $20 - $30. Same cat, high-cost metro: add roughly $6 - $12. Real-world momentLast spring my tabby needed imaging and meds for a sudden GI blockage scare. The bill was $1,450. With a $35/month policy at $250 deductible, 80% reimbursement, the payout was about $960. After that, the year's premiums plus deductible still netted a clear win, which reframed what a "$30 - $40" monthly line item can mean during a bad week. Comparison: cost versus result- Accident-only, $15/mo: Cheap buffer for broken bones or car incidents; no coverage for vomiting, diabetes, or cancer - low cost, narrow result.

- Accident + Illness, $30 - $50/mo: Covers the big-ticket stuff (UTIs, pancreatitis, surgery). Result improves dramatically when a single event hits $1,500 - $4,000.

- Higher deductible plan: Lower monthly, larger hit per claim - efficient if you expect few claims but want catastrophe protection.

- Unlimited limit: Pricier, but flips the result curve during multi-thousand-dollar treatments or repeated episodes.

Edge cases that change the math- Seniors: Premiums jump and some conditions may be excluded; still valuable for diagnostics-heavy years.

- Chronic conditions: If covered after waiting periods, value compounds over time.

- Multi-cat: Small per-pet discounts; the spread of risk across two policies can equal one major claim's benefit.

Fast way to evaluate your quote- Pick a deductible you can pay today ($250 - $500 is common).

- Choose 70%, 80%, or 90% reimbursement and a limit you'd actually use ($5k - $10k or unlimited).

- Collect two quotes: a "value" setup (higher deductible, 70%) and a "comfort" setup (mid deductible, 80 - 90%).

- Run a test bill: $2,000 surgery. Calculate your out-of-pocket in both setups - compare that to 12 - 24 months of premiums.

A careful takeThe price of insuring a cat usually lands between a streaming subscription and a weekly coffee habit, but its result shows up in rare, expensive moments. For some households, that trade feels efficient; for others, saving cash in a vet fund stays compelling. The numbers above get you close, and a few local quotes will narrow it further - there's still a little room to tune.

|

|