|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

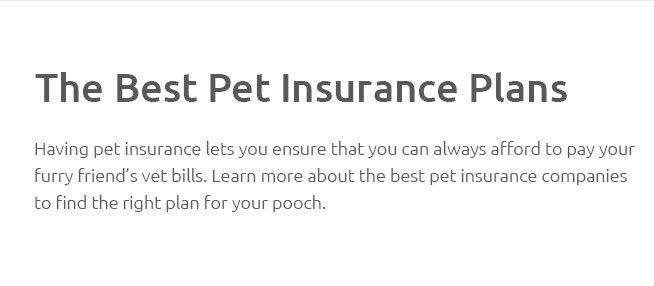

Understanding the Costs of Cat InsuranceCaring for a pet is a rewarding experience that comes with its own set of responsibilities, and one aspect that often garners attention is the cost of cat insurance. It's an investment in your feline friend's health and well-being, providing peace of mind should the unexpected occur. But how much does it truly cost? The answer isn't straightforward; it varies significantly based on several factors. Typically, you can expect to pay anywhere from $10 to $50 per month for comprehensive coverage, depending on your cat's age, breed, location, and the specific coverage plan you choose. Firstly, the age of your cat plays a significant role in determining insurance premiums. Younger cats generally cost less to insure because they are less likely to have developed chronic conditions, whereas older cats may require more frequent veterinary care, thus increasing the insurance cost. Secondly, breed is another crucial factor. Certain breeds are predisposed to specific health issues, which can drive up the cost of insurance. For instance, a Maine Coon, known for its potential heart conditions, might be more expensive to insure than a mixed breed. Location also impacts the price you pay. Pet insurance in urban areas tends to be pricier due to higher veterinary costs compared to rural areas. Moreover, the type of coverage you opt for-whether it be accident-only, time-limited, maximum benefit, or lifetime coverage-will influence the premium. Comprehensive lifetime coverage, which covers your pet for ongoing conditions throughout their life, will understandably be more expensive than basic accident-only plans. From a practical standpoint, when weighing the cost of insurance against potential veterinary expenses, many pet owners find it worthwhile. Imagine your cat develops a serious health issue; treatments can cost thousands of dollars, making insurance a financially savvy choice. However, it’s crucial to read the fine print of any policy to understand exclusions and limits, ensuring it aligns with your expectations and needs. Real-world examples illustrate the importance of considering cat insurance. Take Lucy, a seven-year-old tabby in San Francisco. Her owner pays around $35 monthly for a mid-tier plan. When Lucy needed surgery for a urinary blockage, the insurance covered 80% of the $3,000 vet bill after the deductible, demonstrating the practical benefits of having a policy in place. FAQsQ: Is pet insurance worth the cost? A: Yes, for many pet owners, insurance offers peace of mind and financial protection against unexpected veterinary costs. Q: What factors influence the cost of cat insurance? A: Factors include your cat’s age, breed, your location, and the type of coverage chosen. Q: Can pre-existing conditions be covered? A: Most pet insurance policies do not cover pre-existing conditions, so it's best to insure your pet early. Q: What should I look for in a cat insurance policy? A: Look for comprehensive coverage that suits your budget, and check the policy details for exclusions and limits. Q: How does the deductible affect insurance cost? A: A higher deductible typically lowers the monthly premium but increases out-of-pocket costs when making a claim. https://www.pawlicy.com/blog/pet-insurance-cost/

The average monthly pet insurance premium is $49.51 for dogs and $28.48 for cats, according to the ... https://www.experian.com/blogs/ask-experian/how-much-does-pet-insurance-cost/

Pet insurance for cats typically costs a bit less than insurance for dogs, averaging $31.94 per month or $383.30 per year for accident and ... https://www.embracepetinsurance.com/research/pet-insurance-cost

According to US News, you're looking at an average monthly cost between $26 to $277 for the dog parents out there. Cat owners, you're in luck with slightly ...

|